by Michael J. Dwyer, Principal and Head of Plan, Cost & Review Group

Construction costs are starting to creep up in most major markets. Arena and stadium costs are also increasing. Many construction costs related to stadiums, arenas, and ballparks are higher than standard construction, due to many factors. A typical new stadium is often built adjacent to an existing stadium and the sequencing of demolition of the old, to make way for the new, often brings challenges. Some of the stadiums are built on a footprint that actually encompasses a portion of the old footprint, so sequencing of the work is critical. It is also sometimes hampered if the team is winning and post-season play delays vacancy.

Construction costs for concrete, steel, drywall, conveying systems and MEPs increase with every other construction market. New technology, seen in scoreboards and video equipment, state-of-the-art or local market suite finishes can impact the stadium budget.

There are other cost impacts that must be considered; concessionaire agreements often have required equipment, finishes, and soft goods. It is not so uncommon that the Owner will anticipate running the concessions at closing and then prior to completion a Concessionaire will be retained. There are many reasons that can occur. City/State requirements have a significant impact on the construction costs of stadiums, arenas, and ballparks. Whether it be significant permit fees, off-site improvements, or other items, these requirements need to be priced out and budgeted for from early in the process.

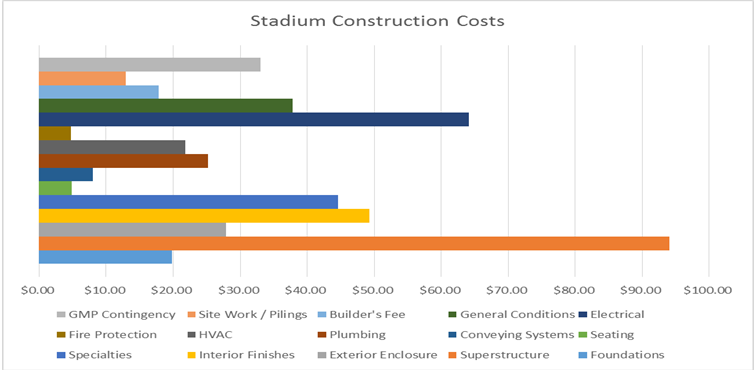

For budgeting purposes, Stadium construction costs are generally around $450/sq. ft. In general, anticipated line item construction costs are as follows:

| TRADE LINE ITEM | $/SF |

|---|---|

| Foundations | 18.88 |

| Superstructure | 70.35 |

| Exterior Glass | 12.25 |

| Exterior Wall | 9.58 |

| Roofing | 5.99 |

| Miscellaneous Iron | 22.64 |

| Interior Partitions | 19.84 |

| Finishes | 28.45 |

| Specialties | 2.36 |

| Scoreboards and Video Screens | 11.56 |

| Equipment and Furnishings | 28.74 |

| Seating | 4.84 |

| Elevators/Escalators | 8.00 |

| Plumbing | 25.24 |

| HVAC | 21.81 |

| Fire Protection | 4.69 |

| Electrical | 61.14 |

| General Conditions | 32.81 |

| Builder’s Fee | 17.82 |

| Subtotal Building | $407.01 |

| Site Work / Pilings | 12.98 |

| GMP Contingency | 30.01 |

| Total Hard Costs | $450.00 |

Merritt & Harris, Inc. has been providing construction cost analyses for over 77 years and our industry leading cost reviews are essential to the loan process. Over my career at Merritt & Harris, we have provided cost analyses for 35 stadiums, arenas, and ballparks. If you would like to discuss your project or have general construction cost questions, please contact me at 212.697.3188, ext. 309.

For myself, I know personally how caring Tom is and I am thankful. I had a medical emergency back in 2007 and, without hesitation, Tom flew down to Florida to be with me and my family through this time of need. Work was put on hold, while family needs were brought to the forefront. In my opinion, this is what makes a great leader. While we always work hard, strive to make profits, and look at the bottom line, when family calls, everything else should take a backseat.

For myself, I know personally how caring Tom is and I am thankful. I had a medical emergency back in 2007 and, without hesitation, Tom flew down to Florida to be with me and my family through this time of need. Work was put on hold, while family needs were brought to the forefront. In my opinion, this is what makes a great leader. While we always work hard, strive to make profits, and look at the bottom line, when family calls, everything else should take a backseat.